A proven 3-account setup that makes cash flow feel calm, clear, and reliable. Automate bills, spending, and saving with fewer mistakes and more peace.

In December 2025, money feels faster than your brain. Payments move in seconds. Subscriptions renew quietly. Prices change often. Consequently, many people earn enough but still feel broke, stressed, and stuck.

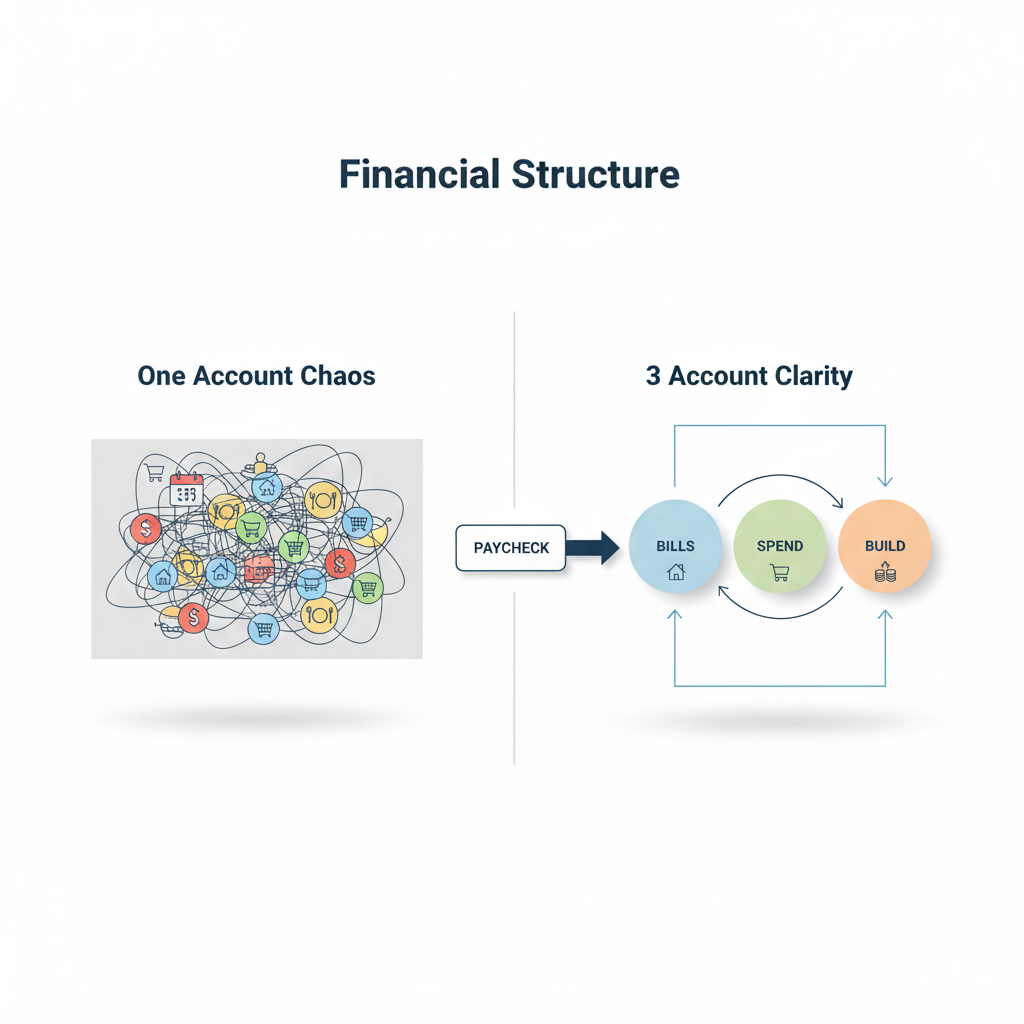

The problem is rarely intelligence. It is usually structure. When every dollar lands in one account, every decision becomes a daily fight. That fight drains willpower. Moreover, it makes “budgeting” feel like punishment.

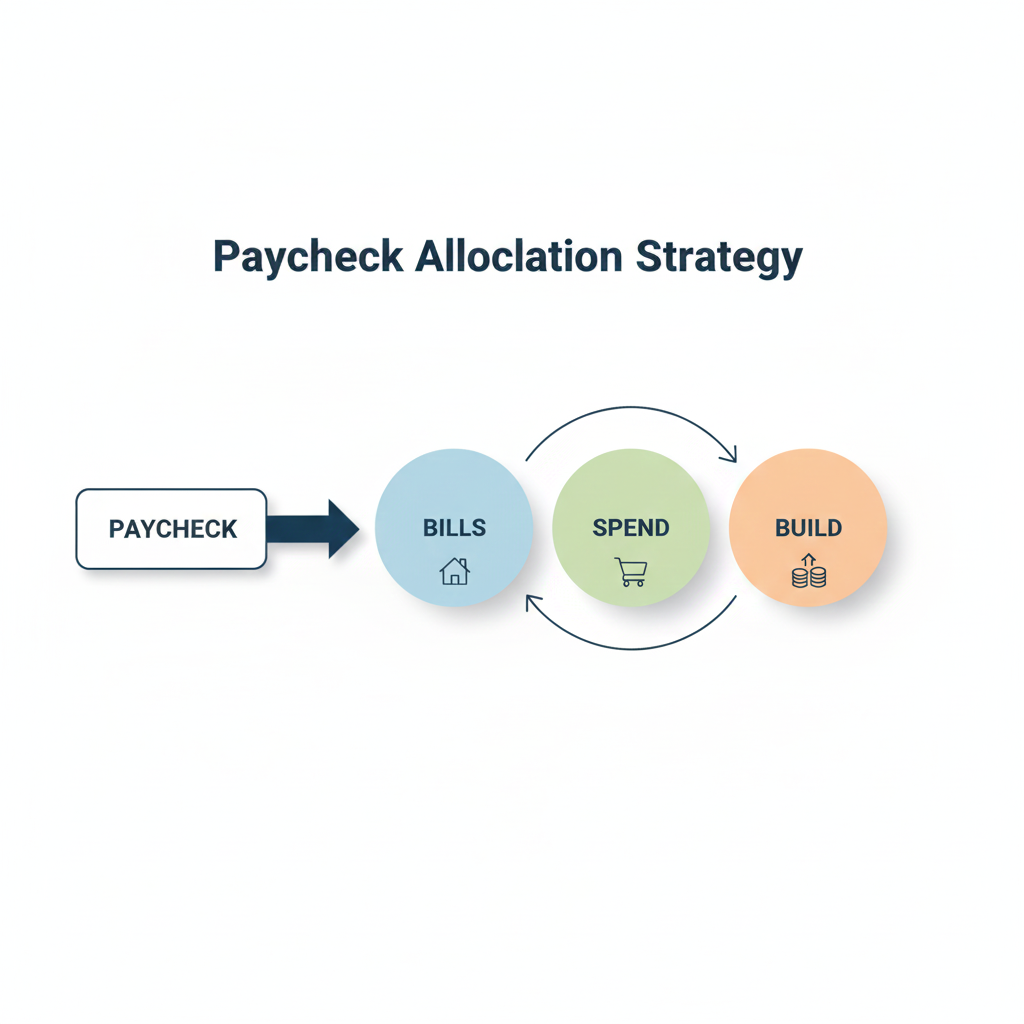

The 3-account system fixes the root cause. It separates your money by job. One account pays bills. One account is for everyday spending. One account builds your future. You automate the flow, then you stop thinking about it all day.

This guide gives you a simple, future-ready setup. You will build a clean system that works with modern banking, instant transfers, and stronger data-sharing rules that are spreading into 2026. Additionally, you will learn how to protect yourself from fraud and automation mistakes, so your plan stays safe and stable.

What the 3-account system really is

The simple idea that creates powerful control

The 3-account system is a cash-flow operating system. It is not a spreadsheet lifestyle. It is not a complex tracker. It is a clear map.

Account one is for bills. Account two is for spending. Account three is for saving and goals. Each account has one job, which is crucial. When accounts have mixed jobs, you lose clarity. When jobs are clean, your decisions feel easy and confident.

This is why the system works even for beginners. It reduces choices. It reduces guilt. It reduces chaos. Consequently, it feels like a breakthrough, even though it is simple.

Why this beats “one checking + one savings”

A single checking account becomes a messy pool. Bills, groceries, and goals all compete. One surprise expense can wipe out your plan. Moreover, your brain cannot quickly see what is safe to spend.

The 3-account system creates instant truth. You can check your spending account and know, fast, what you can use today. You can check your bills account and feel secure that rent and utilities are covered. You can check your goals account and feel motivated by visible progress.

That visibility is emotionally rewarding. It also builds trust in your own plan.

Why it is rising again in a high-tech world

It sounds old-school. Yet it fits the future.

Open banking tools are improving. Instant payments are expanding. Also, consumer data rights rules are pushing finance apps to connect more safely, with better consent and security. In the U.S., the CFPB issued a final rule on personal financial data rights under Section 1033 in October 2024. (Consumer Financial Protection Bureau)

Meanwhile, instant payment networks keep growing. In the U.S., the Federal Reserve’s FedNow went live July 20, 2023, and has continued adding participation and use cases. (Federal Reserve) These shifts make automation more immediate. They also increase the need for a clear structure, because money moves faster than mistakes.

What is emerging in cash-flow automation through 2026

Instant payments make timing more precise

Instant payments are no longer a niche feature. Banks and fintechs keep building toward faster settlement and 24/7 movement. FedNow is one clear example, and major institutions describe a broader move toward real-time payment networks. (Federal Reserve)

This matters for your 3-account system. Faster transfers reduce “waiting days.” They also reduce excuses. However, they increase risk if you automate blindly. Therefore, your setup must include guardrails like alerts, limits, and a buffer.

Open banking is making automation smarter

Open banking is expanding beyond simple account viewing. It is moving toward safer data sharing and payment initiation, with stronger consent. Large institutions discuss where open banking is heading, and many industry trend reports expect more automation and personalization. (JPMorgan Chase)

For you, the practical implication is exciting. You can automate categorization, detect bill spikes, and trigger transfers based on rules. Yet the core structure still matters. Without structure, automation only moves chaos faster.

Split direct deposit is the quiet hero

The most reliable automation is the one that happens before you can spend. Split direct deposit lets you send parts of your paycheck to different accounts automatically. NACHA explains how employees can use split deposit to divide pay across accounts, such as checking and savings. (nacha.org)

This is a powerful lever. It builds discipline without pain. It is also future-proof, because it relies on payroll and banking rails, not on motivation.

[YouTube Video]: A clear walkthrough of the three-account method and why it reduces stress. Watch this early to lock the concept in your mind.

Step 1: Choose your three accounts the smart way

Pick a structure that stays simple

Your system must feel clean. If it feels complicated, you will quit. Therefore, do not start with seven accounts. Start with three.

You can use one bank or multiple banks. Both can work. One bank is simpler to manage. Multiple banks can create stronger separation. Additionally, a separate bank can reduce impulse transfers.

Your goal is a reliable system you will actually use.

Account 1: Bills and obligations

This account is boring on purpose. It holds money for rent, utilities, subscriptions, debt payments, insurance, school fees, and any fixed obligation.

A strong bills account creates calm. It stops last-minute panic. It also protects relationships, because you stop borrowing to cover essentials.

Keep this account stable. Avoid a debit card for daily use if you can. Moreover, avoid linking it to shopping apps.

Account 2: Spend and daily life

This account is your everyday freedom. It covers groceries, transport, eating out, small shopping, and fun. It is the account you check before you say yes to a purchase.

This account reduces guilt because it creates permission. When the spend account has money, you can spend it with confidence. When it is low, you slow down with clarity, not shame.

Account 3: Build and future goals

This is the account that changes your life. It holds emergency savings, sinking funds, investments, and major goals.

A high-yield savings account can be attractive for this bucket, if it is insured and accessible. Bankrate advises verifying FDIC or NCUA insurance when choosing high-yield savings, and highlights practical criteria like rates and fees. (Bankrate)

If you invest, your investing account can be separate from savings. Still, keep the “build” idea unified. This account is about progress, security, and a rewarding future.

Step 2: Define what each account must cover

Start with a clear bills number

The bills account should be funded based on your real monthly obligations. Use the last 2 to 3 months to estimate. If you do not have records, start with your best guess and refine.

Include yearly or irregular bills too. Those are “sinking funds.” Examples include car maintenance, annual insurance, travel, school costs, or holidays. Additionally, include predictable health costs if relevant.

This step is crucial. If you underfund bills, your system will collapse and feel unreliable.

Set a spending limit that still feels livable

Your spending account is not a punishment. It is a boundary that protects you. Make it realistic. If it is too tight, you will rebel. If it is too loose, goals will stall.

A strong starting point is to choose a weekly spending amount that you can repeat. Weekly feels more real than monthly. Moreover, weekly prevents the classic “spent it all in week one” problem.

Decide what “build” means for you

Build can include:

Emergency fund growth.

Sinking funds.

Debt payoff beyond minimums.

Investing.

Major goals.

You do not need perfection. You need direction.

A powerful emotional trick helps here. Name the build account with a motivating label, such as “Freedom Fund” or “Future.” That small label can feel inspiring, especially during weak moments.

Step 3: Fund the system with a simple, proven split

Use a starter split, then refine

You can start with a simple split, then adjust after a month. The key is to begin. Waiting for perfect numbers is a trap.

A calm approach is:

Bills get what they must.

Build gets a fixed amount or a fixed percentage.

Spend gets the remainder.

This is less “mathy.” It is also more reliable.

If you have irregular income, use a buffer method

Irregular income makes people feel stuck. Yet the 3-account system can still work.

First, build a “buffer” inside the bills account. The buffer can be a small cushion, like one extra week of bills. That cushion makes your system stable even when income timing changes.

Then, use a “pay yourself weekly” transfer from bills to spend. This creates a steady rhythm. Consequently, your brain relaxes.

If you are paid weekly, keep the rhythm weekly

Match your automation to your paycheck rhythm. If you are paid weekly, do weekly transfers. If you are paid biweekly, do biweekly. This reduces confusion.

Consistency creates confidence. Confidence creates follow-through.

Step 4: Automate the flows with modern tools

Automate at the source with split direct deposit

Split direct deposit is one of the most powerful moves. NACHA explains that you can ask your employer to split your direct deposit by percentages or fixed amounts, so saving happens automatically. (nacha.org)

If your employer supports it, route:

A fixed amount to bills.

A fixed amount to build.

The remainder to spend.

This feels like magic, because your plan happens before temptation.

Bankrate also describes how split direct deposit works and why it helps, including the idea of “training yourself to live on less everyday spending cash.” (Bankrate)

If payroll cannot split, automate transfers on payday

Some employers cannot split, or the process is slow. In that case, automate transfers the same day your pay hits. Many banks let you schedule recurring transfers.

Schedule transfers in this order:

Bills first.

Build second.

Spend gets the rest.

This order is psychologically powerful. It protects what is vital. It also makes spending feel clean and permission-based.

Automate bills from the bills account only

Bills should leave only from the bills account. This rule is essential. If bills hit your spending account, you lose clarity fast.

Set autopay for fixed bills. For variable bills, set reminders or alerts. Additionally, consider a small “utilities cushion” in the bills account to avoid overdrafts.

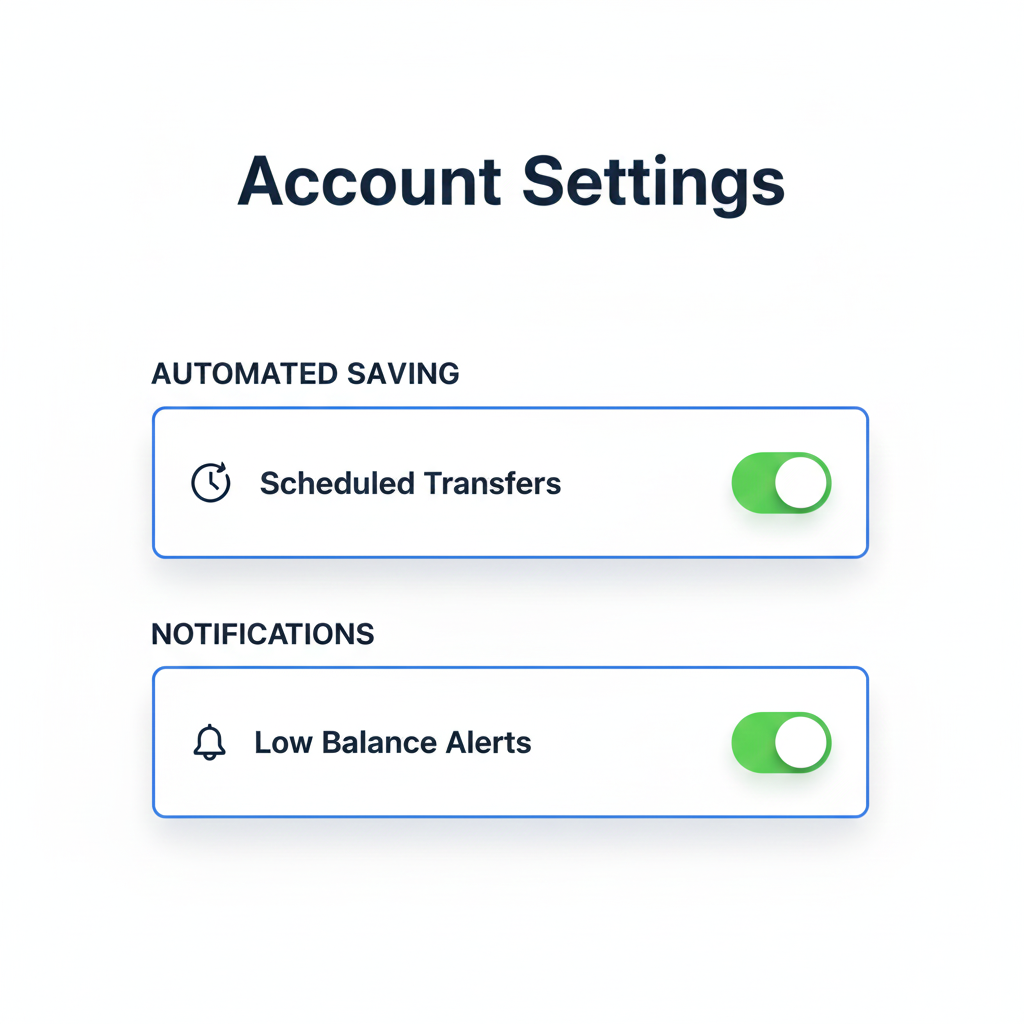

Add guardrails that prevent silent failure

Automation is powerful. It can also fail quietly.

Add:

Low-balance alerts on bills.

Large-transaction alerts on spending.

Login alerts if your bank offers them.

These guardrails create safety. They also reduce the fear of “What if I missed something?”

Step 5: Run a 10-minute weekly check that keeps you in control

Check the spend account first

The spend account tells you how the week is going. If it is low early, you adjust calmly. If it is healthy, you enjoy life without guilt.

This is emotionally rewarding because it creates clear feedback. It also stops surprise shame at month-end.

Check bills for upcoming spikes

Look for upcoming annual renewals or large utilities. If something is rising, move money inside the bills account. Do not steal from build unless it is truly necessary. Moreover, do not pretend it is not happening.

Clarity beats denial. Denial breaks systems.

Check build for momentum

This is your motivation fuel. Even small progress is powerful. It builds identity. It creates hope. Additionally, it creates resilience when life hits.

[YouTube Video]: A practical “cash flow system” implementation session. Helpful when you want the steps to feel real and doable.

Step 6: Upgrade the system for 2026 trends

Use open banking safely, with consent and clarity

Budgeting apps can connect to your accounts. They can help you see patterns and forecast bills. However, access and data sharing must be done carefully.

In the U.S., the CFPB’s personal financial data rights rule under Section 1033 aims to require covered data providers to make covered data available to consumers and authorized third parties, with privacy and security obligations. (Consumer Financial Protection Bureau)

This is part of a bigger shift. Many institutions and analysts expect open banking and open finance to keep expanding, with more automation and security focus. (JPMorgan Chase)

Practical move: use apps that support strong consent flows and clear permissions. Additionally, review connected apps twice a year. Remove what you do not need.

Expect faster transfers and tighter timing

Instant payment rails are advancing. FedNow is one example of a system designed to enable instant payments through depository institution accounts. (Federal Reserve) Industry discussions also note the growing role of real-time payment networks in modern cash management. (JPMorgan Chase)

This trend makes your 3-account system even more valuable. Transfers can happen faster. Yet mistakes can too. Therefore, keep buffers. Keep alerts. Keep your rules clean.

Prepare for smarter AI budgeting assistants

AI budgeting tools will keep improving. They will predict bills, flag spending spikes, and suggest new splits. That is exciting and potentially life-changing.

Still, AI is only as good as your structure. A messy structure produces messy advice. Consequently, your best move is to keep the 3-account system as your stable foundation, then let tools sit on top.

Step 7: Security and stability rules that protect your plan

Use insured accounts for core cash

If you are using banks or credit unions, deposit insurance matters. In the U.S., the FDIC explains that deposits are insured to at least $250,000 per depositor, per FDIC-insured bank, for covered deposit products. (fdic.gov)

Even outside the U.S., the principle is the same. Keep core cash in regulated, reputable institutions. It is a vital safety layer.

Be cautious with links, requests, and “urgent” messages

Fraud evolves fast. Payment scams often target impulse and urgency. Your system should reduce impulse, not increase it.

A simple rule helps: never move money from bills or build due to a rushed message. Verify first. Additionally, prefer moving money only during your weekly check, unless it is a true emergency.

Keep the build account harder to access

Friction can be protective. If your build account is too easy to drain, it becomes a backup spending account.

Consider:

No debit card for build.

Transfers that take a day, when possible.

Separate bank login.

This creates a calm barrier. It protects your future.

Common mistakes that quietly break the 3-account system

Mistake one: Bills account is underfunded

This creates constant transfers and stress. It also creates overdraft risk. Fix it by raising bills funding and adding a buffer.

Mistake two: Spending account is unrealistically low

When spending is too tight, the system feels harsh. People then “borrow” from build, which kills momentum.

Fix it by choosing a spending level that feels honest. Additionally, cut one or two big leaks rather than starving everything.

Mistake three: Build account has no clear purpose

A vague build account feels meaningless. Meaning drives consistency. Therefore, give build a goal with a name and a timeline.

Mistake four: Too many accounts too soon

More accounts can help later. Yet early complexity is a trap.

Start with three. Master the flow. Then add a sub-goal account only if it creates clarity, not confusion.

A simple 14-day launch plan that feels doable

Days 1 to 3: Set up the accounts and names

Open or rename accounts. Choose simple labels. Make them emotionally clear.

Days 4 to 7: Map bills and choose your first split

List obligations. Estimate monthly totals. Pick your first split. It can be imperfect. It just needs to be real.

Days 8 to 10: Turn on automation and alerts

Set transfers. Set autopay from bills. Set alerts. This is the heart of the system.

Days 11 to 14: Run the first weekly check and adjust

Do a 10-minute check. Adjust your split slightly. Do not overreact. Small changes are powerful.

This launch plan is short on purpose. It is designed to feel rewarding, not exhausting.

Why this system stays powerful for years

The 3-account system is simple, yet it matches how modern money behaves. It works with fast payments. It works with automated bills. It works with split direct deposits. It also works with the coming wave of smarter financial tools and stronger data-sharing rules.

Most importantly, it protects your mind. When structure is clear, money stops being a daily emotional fight. Consequently, you feel calmer. You feel more confident. You make better choices.

Your next step is straightforward. Create the three accounts. Set one split. Automate it. Then let the system do the heavy lifting.

Sources and References

- Required Rulemaking on Personal Financial Data Rights (CFPB) (Consumer Financial Protection Bureau)

- Required Rulemaking on Personal Financial Data Rights (Federal Register) (Federal Register)

- FedNow Service Overview (Federal Reserve) (Federal Reserve)

- FedNow progress update: Two years of growth (FRB Services) (frbservices.org)

- Instant payments overview: RTP and FedNow (J.P. Morgan) (JPMorgan Chase)

- Split deposit basics (NACHA) (nacha.org)

- Split direct deposit: how it works (Bankrate) (Bankrate)

- Deposit insurance explained (FDIC) (fdic.gov)

- Open banking: where it goes next (J.P. Morgan) (JPMorgan Chase)

- Open Banking in 2026: trends and what to expect (Fabrick) (fabrick.com)